The Infrastructure Triangle: Why AI, Energy, and Blockchain Are Converging

Federal policy is aligning around AI dominance and energy expansion. Enterprise blockchain becomes the coordination layer.

The Infrastructure Triangle: Why AI, Energy, and Blockchain Are Converging

A BlockSkunk Analysis

Federal policy is aligning around AI dominance and energy expansion. Enterprise blockchain becomes the coordination layer.

Something significant happened in the second half of 2025 that most people missed.

In October, the White House declared National Energy Dominance Month —a full-throated commitment to expanding domestic energy production. In December, an executive order established a unified national AI policy framework , preempting the patchwork of state regulations that had been slowing deployment. And back in July, the administration released “Winning the Race: America’s AI Action Plan” , which included a line that should have gotten more attention than it did:

“AI is the first digital service in modern life that challenges America to build vastly greater energy generation than we have today.”

That’s not hyperbole. It’s math.

The plan is part of a broader push that analysts project will require up to $7 trillion in global data center investment by 2030 . Data center power demand is expected to reach 6.7% to 12% of total U.S. electricity consumption by 2028 —potentially tripling current levels. Microsoft signed a 10.5-gigawatt energy framework deal with Brookfield —the largest single corporate renewable energy agreement ever announced. Meta, Google, and Amazon are all in a land grab for power.

Mark Zuckerberg put it bluntly in an interview with Dwarkesh Patel: “Energy, not compute, will be the #1 bottleneck to AI progress.”

Federal policy is now explicitly aligned around two priorities: AI dominance and energy expansion. The infrastructure to support both is being built right now. But there’s a gap that hasn’t been addressed.

Who coordinates it?

The Coordination Problem

Here’s the challenge nobody talks about at AI conferences.

The traditional energy model—centralized utilities, single points of procurement, predictable grid relationships—doesn’t scale fast enough. You can’t build enough centralized power plants, get them permitted, and connect them to the grid in time to meet AI demand curves. The math doesn’t work.

The solution everyone is converging on is distributed generation: solar installations, microgrids, battery storage, on-site generation, power purchase agreements with independent producers. Microsoft’s Brookfield deal isn’t for a single power plant—it’s a framework for assembling distributed energy resources across multiple sources and geographies.

Distributed energy solves the supply problem. But it creates a different problem: coordination.

When you have dozens of energy producers, multiple off-takers, varying generation profiles, real-time pricing, carbon accounting requirements, and enterprise customers demanding 24/7 verified clean energy—you have a reconciliation nightmare. Who produced what energy, when? Who consumed it? How do you prove provenance to a customer like Microsoft that requires carbon-free verification? How do you settle payments across multiple parties without a six-month audit cycle?

Spreadsheets don’t scale. Manual reconciliation doesn’t scale. Trust-based arrangements between counterparties don’t scale.

This is a coordination problem. And coordination problems are exactly what enterprise blockchain infrastructure was designed to solve.

Three Technologies That Need Each Other

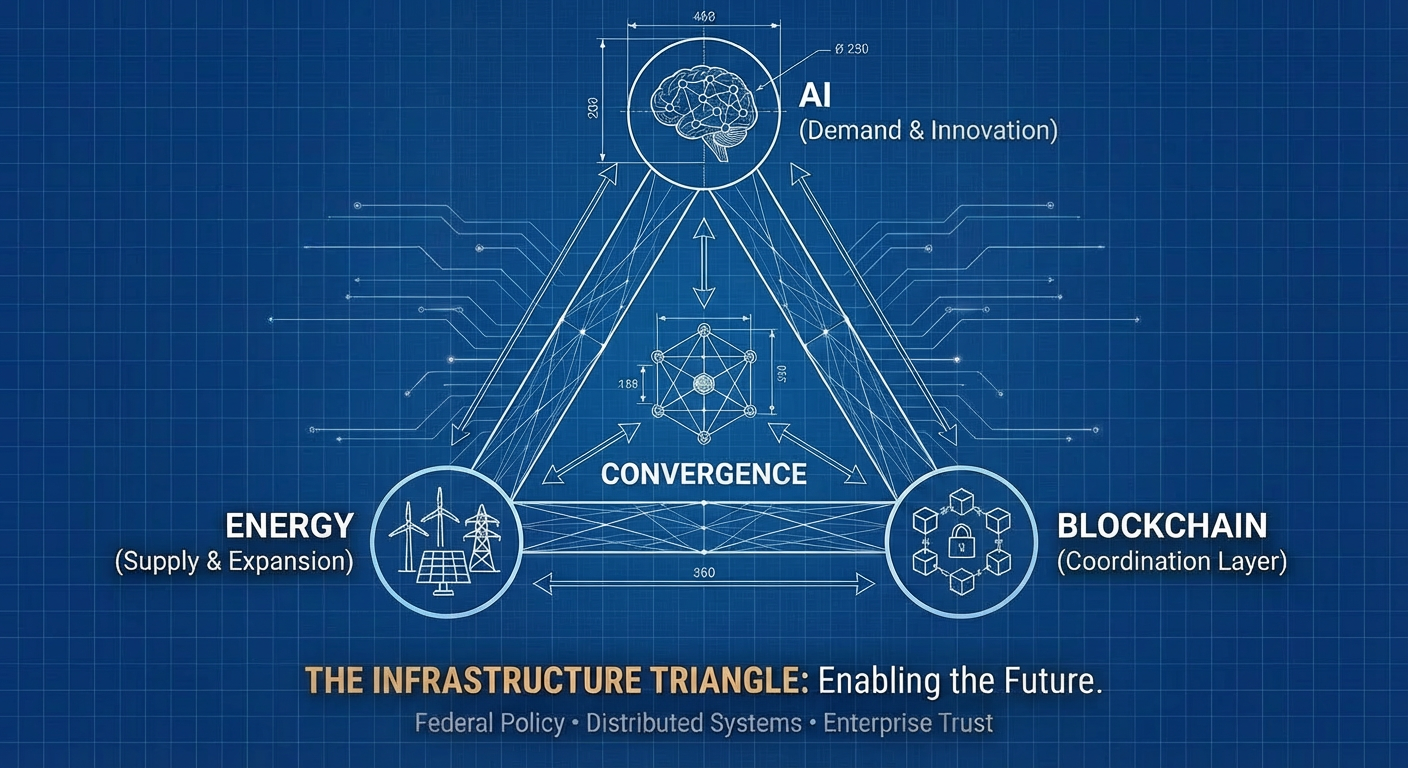

The convergence happening right now isn’t accidental. It’s structural.

AI needs predictable, low-cost, always-on power. We’re talking 99.999% uptime—about five minutes of downtime per year. AI workloads can’t pause because the grid is stressed. The economics of AI inference depend on power costs staying within a narrow band. Volatility kills margins.

Distributed energy is the only path to meeting demand at the speed required. But distributed systems are inherently complex. Multiple producers, multiple consumers, varying outputs, different contractual arrangements, regulatory requirements that vary by jurisdiction. Every transaction creates data that needs to be captured, verified, and settled.

Enterprise blockchain provides the shared infrastructure that makes multi-party coordination work without requiring every participant to trust each other—or to build point-to-point integrations with every counterparty. One source of truth. Automated settlement. Immutable audit trails.

These three technologies aren’t parallel trends. They’re interdependent. AI creates the demand. Distributed energy meets the supply. Blockchain coordinates the complexity in between.

The AI Action Plan calls for “new sources of energy at the technological frontier”—enhanced geothermal, nuclear, and distributed generation. It calls for streamlined permitting for data centers and energy infrastructure. It calls for public-private collaboration on the buildout.

What it doesn’t spell out is the coordination layer that makes all of this work at scale. That’s the opportunity.

Why Enterprise Managed Blockchain-as-a-Service

Let’s be specific about what kind of blockchain infrastructure fits this problem—because most of what people think of as “blockchain” doesn’t apply here.

Public blockchains are designed for open, permissionless networks. That’s valuable for certain use cases. But enterprise energy infrastructure requires something different:

- Predictable costs. You can’t run critical infrastructure on a network where transaction fees spike 10x during periods of congestion.

- Privacy. Energy procurement data is commercially sensitive. Competitors participating in the same grid can’t see each other’s pricing or volumes.

- Compliance. Regulated industries need audit trails that satisfy external auditors, not pseudonymous transactions.

- Integration. Enterprise systems—ERPs, SCADA, building management—need to connect. That requires APIs, not wallet addresses.

The traditional approach to enterprise blockchain has been slow and expensive. Eighteen to twenty-four month deployment cycles. Unpredictable budgets. Consulting engagements that never quite reach production. Cloud providers offer infrastructure, but you still need blockchain expertise to build on it.

Enterprise managed blockchain-as-a-service (mBaaS) changes this equation. This is exactly the problem BlockSkunk was built to solve. Where others advise or audit, we deploy. Our managed blockchain-as-a-service transforms those 18-24 month timelines into 90-120 day production deployments. Compliance-native architecture—built from the protocol level for regulatory requirements, not retrofitted.

Four capabilities matter for energy infrastructure coordination:

Distributed Verification. Multiple independent parties validate transactions before finalization. No single entity controls the network. This meets regulatory requirements for operational resilience and creates the foundation for multi-party trust.

Automated Policy Enforcement. Business rules and compliance requirements execute automatically at the protocol level. Non-compliant transactions get rejected before processing, not discovered in an audit six months later.

Cryptographic Audit Trail. Every action permanently recorded with digital signatures and timestamps. Tamper-evident, immutable records. When an enterprise customer asks for proof of renewable energy sourcing, you have cryptographic evidence—not a spreadsheet.

Configurable Privacy Zones. Participants see only the data they’re authorized to access. Bilateral transactions stay private. Shared workflows remain visible to authorized parties. Competitors can participate in the same network without exposing commercial details to each other.

This isn’t theoretical. J.P. Morgan has been exploring blockchain-based energy coordination with Shell , testing how decentralized physical infrastructure networks (DePINs) could orchestrate real-world energy systems. The bank has also partnered with companies like Cleartrace to track renewable energy consumption using blockchain . The infrastructure patterns are established. The question is who deploys them at scale.

What This Looks Like in Practice

Three use cases illustrate where blockchain coordination creates value in AI energy infrastructure:

Energy Provenance Tracking

Microsoft, Google, and Amazon don’t just want renewable energy. They want verified renewable energy— 24/7 carbon-free matching , not annual renewable energy certificates that let you claim credit for solar power generated while your data center was actually drawing from coal plants at 2 AM.

Blockchain creates tamper-proof records of when and where renewable energy was generated, matched against when and where it was consumed. Real-time verification, not annual reconciliation. Selective disclosure lets customers verify sourcing without exposing the commercial terms of your power purchase agreements.

The outcome: Enterprise AI customers get the verification they need. Energy providers get a premium for provable clean power. Auditors get cryptographic evidence instead of attestations.

Renewable Asset Coordination

Renewable energy markets are opaque and slow. Verification is manual. Double-counting is a persistent problem—the same megawatt-hour getting claimed by multiple parties.

Tokenizing renewable energy assets within a permissioned network creates efficient, auditable markets. Each kilowatt-hour of verified generation becomes a trackable asset with digital signatures and timestamps. Identity-verified participants ensure only legitimate parties can trade. Smart contracts automate settlement.

The outcome: Lower transaction costs. Faster settlement. Eliminated double-counting. A more liquid market for the renewable energy that AI infrastructure requires.

Multi-Party Settlement

A typical distributed energy installation might serve multiple off-takers: a data center, a residential community, grid export during peak pricing. Allocation gets complicated. Disputes arise. Reconciliation takes months.

Blockchain automates transparent allocation based on pre-agreed rules. Smart contracts execute settlement without manual intervention. Every party sees the same data. Disputes drop because there’s one source of truth.

The outcome: Reduced administrative overhead. Faster cash cycles. Relationships that scale because they don’t depend on trust alone.

Why This Is Happening Now

The policy alignment isn’t coincidental. Three federal actions in six months created a window:

National Energy Dominance Month (October 2025) signaled that domestic energy production is a national priority. Permitting reform, production incentives, and public messaging all aligned around expansion.

America’s AI Action Plan (July 2025) made explicit that AI infrastructure requires energy infrastructure. The trillion-dollar investment projections, the calls for streamlined permitting, the emphasis on public-private partnership—this is industrial policy aimed at a specific outcome.

Unified AI Policy Framework Executive Order (December 2025) preempted state-level regulatory fragmentation. For enterprises operating across jurisdictions, this creates a clearer compliance environment. You’re not navigating fifty different rule sets.

The market is responding. Capital is flowing into AI infrastructure at unprecedented scale. But capital alone doesn’t solve coordination. The enterprises that build governed, auditable, multi-party infrastructure now will be positioned to capture value as the buildout accelerates.

Compliance is becoming a competitive advantage. When enterprise AI customers evaluate energy providers, they’re asking about verification, audit trails, and governance. The providers who can demonstrate cryptographic proof of their claims—not just attestations—will win the contracts.

Why Blockchain Is the Missing Infrastructure Layer

The skeptic’s question is fair: why does this require blockchain? Can’t you solve coordination with a shared database and some APIs?

You can try. Many have. Here’s why it doesn’t hold up at scale.

The trust problem is structural. In a distributed energy network, participants are often competitors. A solar developer, a utility, a data center operator, and a grid balancing authority all have different incentives. No single party should control the ledger. No single party should be able to modify records after the fact. When disputes arise (and they will), every party needs confidence that the data hasn’t been manipulated. A shared database controlled by one participant doesn’t solve this. A blockchain with distributed verification does.

Audit requirements are intensifying. Enterprise AI customers aren’t just asking for renewable energy. They’re asking for proof. Microsoft’s 24/7 carbon-free energy commitment requires verification at the hourly level, matched to actual consumption. Google has similar requirements . These aren’t PR statements; they’re contractual obligations flowing down to suppliers. The audit trail needs to be tamper-evident, timestamped, and independently verifiable. Traditional databases can be modified by administrators. Blockchain records cannot.

Multi-party settlement is expensive without automation. When energy flows between multiple producers and multiple consumers, reconciliation becomes a full-time job. Disputes over allocation, timing, and pricing consume months of back-and-forth. Smart contracts that execute automatically based on pre-agreed rules eliminate this friction. Settlement happens in real-time, not quarterly. Cash cycles compress. Relationships scale because they don’t depend on manual oversight.

Regulatory expectations are moving toward verifiable infrastructure. The AI Action Plan emphasizes “secure-by-design” systems. The NIST AI Risk Management Framework calls for trustworthy, auditable infrastructure across the AI supply chain. Energy is part of that supply chain. As regulators pay more attention to AI infrastructure, the ability to demonstrate governance at the energy layer becomes a differentiator. Blockchain provides cryptographic proof of compliance, not just attestations.

Interoperability without integration hell. Point-to-point integrations between every participant in a distributed energy network create exponential complexity. Every new participant requires new connections to every existing participant. Blockchain provides a shared protocol layer. New participants connect once to the network, not separately to every counterparty. This is how you scale from pilot to production without rebuilding integrations every time.

The question isn’t whether coordination infrastructure is needed. It’s whether you build it on foundations designed for multi-party trust, or retrofit trust onto systems that weren’t designed for it. The enterprises getting this right are choosing purpose-built infrastructure from the start—and deploying it in months, not years.

The Coordination Layer for What Comes Next

The AI Action Plan includes a line worth remembering: “Whoever has the largest AI ecosystem will set global AI standards and reap broad economic and military benefits.”

This is an infrastructure race. Compute is part of it. Energy is part of it. But the enterprises that figure out coordination—that build the governed, multi-party systems connecting AI demand to distributed energy supply—will own something more durable than any single data center.

Blockchain doesn’t solve the energy problem. It solves the coordination problem that makes distributed energy work at scale.

The policy window is open. The capital is flowing. The technology exists. The question is who builds the trusted infrastructure layer for what comes next.

BlockSkunk builds compliant blockchain infrastructure for enterprises navigating this convergence. We believe financial and energy innovation should enhance transparency, reduce systemic risk, and improve access—not compromise it. If you’re building at the intersection of AI, energy, and distributed coordination, let’s talk .

This analysis was prepared by BlockSkunk , specialists in rapid, compliant blockchain managed services. It reflects publicly available federal policy documents and market developments and does not constitute legal, investment, or regulatory advice.

Sources

Federal Policy Documents

- National Energy Dominance Month Proclamation (October 2025)

- America’s AI Action Plan (July 2025)

- AI Action Plan Full Document

- Executive Order: Ensuring a National Policy Framework for AI (December 2025)

Data Center & Energy Demand

- DOE Report on Data Center Electricity Demand

- McKinsey: The Cost of Compute - $7 Trillion Race

- Goldman Sachs: AI to Drive 165% Increase in Data Center Power Demand

- Gartner: Data Center Electricity Demand to Double by 2030